How can you determine the psychological condition of the market?

We developed empirical indicators based on an in-depth analysis of several types of variables, many of which based on transactions in derivatives markets.

A number of those variables were harmonised and statistically handled, in order to get a general behavioural index.

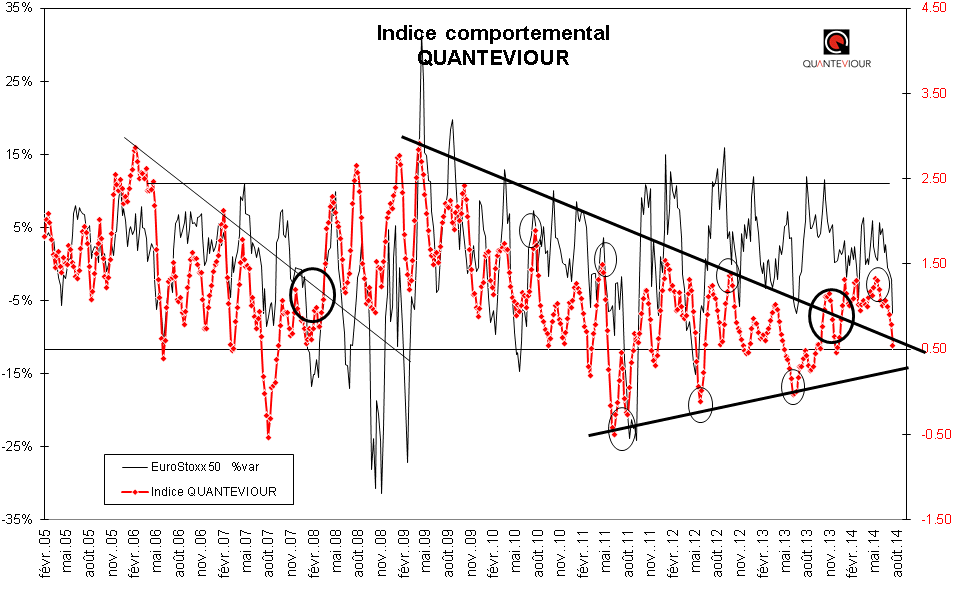

This is what has become the Quanteviour Behavioural Index, for which we are presenting hereunder a mid-term illustration.

Quanteviour Behavioural Index

It strategically shows the global psychological condition on the Equity markets. Of course, it’s only after a thorough analysis of all variables and when a strong convergence emerges between different types of parameters, both economical and behavioural, that we get reliable investment decisions.

We have classified those instruments into four broad categories.

Confidence indexes (survey results)

- Manufacturing indexes (IFO, ISM, PMI,…)

- Consumer indexes

- Investor indexes (private and institutional)

Behavioural indicators (investors’ acts analysis)

- Systematic and quantitative analysis of derivatives markets

- Financial flows analysis (within underlying asset and assets classes)

- Analysis of analysts’ behaviour

- Media analysis (journalists behaviour)

Sentiment indicators

- Transaction flows and volatility cross-analysis

Technical analysis indicators

- Changes in relative prices (market preferences)